how to get uber eats tax summary

Answer Yes to Did you have any self-employment income or expenses. Review the expenses in your Uber Tax Summary.

Uber Eats Order Summary Explained

To achieve this take the total amount you made minus Uber fees and business expenses.

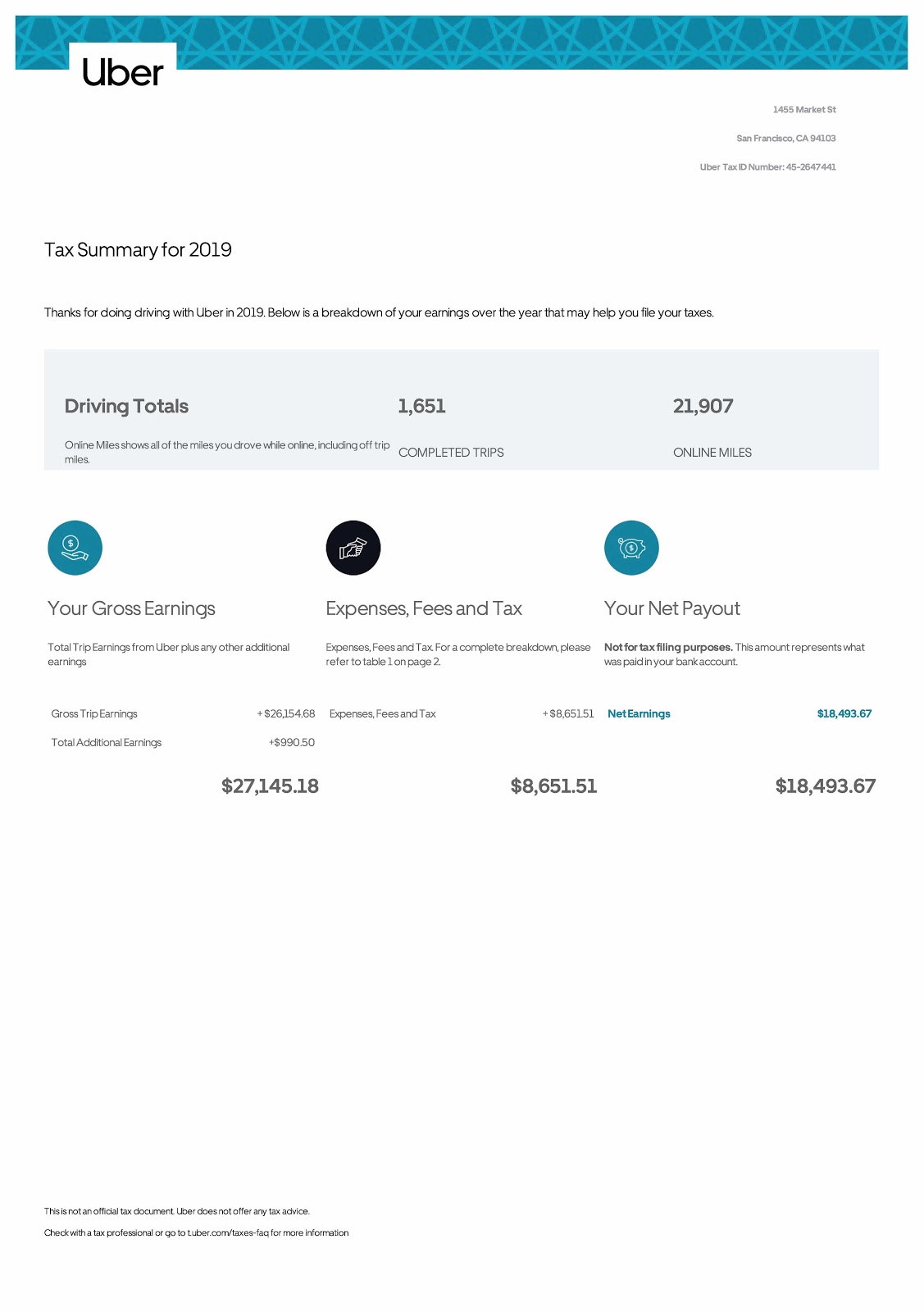

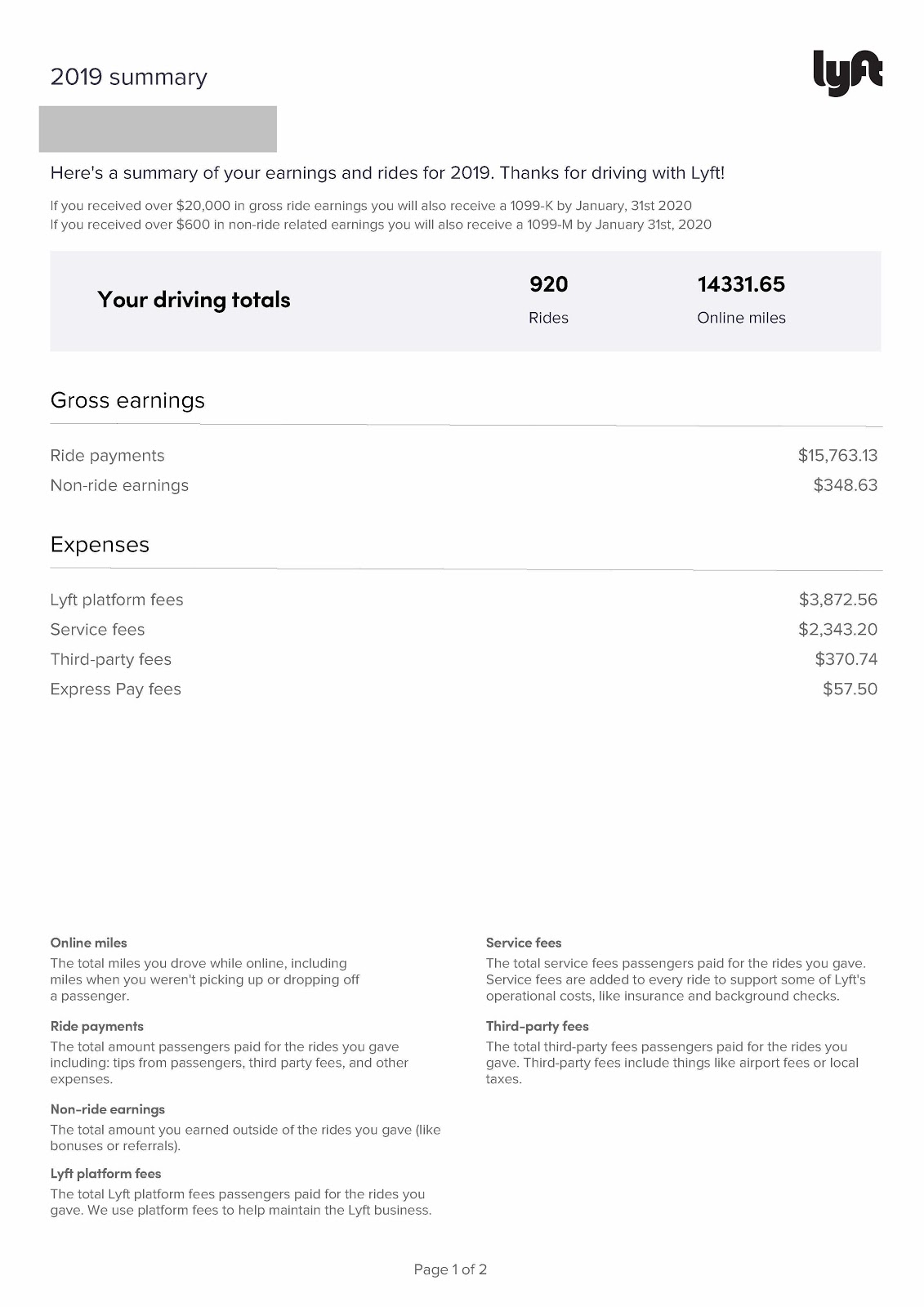

. This is not an official tax document but it will help you or your preferred tax professional better understand your possible deductions when filing your taxes. Certain Uber expenses need to be combined and entered as a single amount in TurboTax. Select the Tax Information tab at the top.

You can log into your Uber profile and input your number by following these instructions. Select the Tax Information tab at the top. You can also find a copy of your 1099 in your Uber app by going to Account - Tax Info - Tax Forms.

If you are responsible to collect sales tax based on this threshold you will need to provide Uber Eats your HSTGST registration number. How to Find Your Uber Tax Documents. In addition you should be able to download them in your Driver App under Account Tax Info Tax Forms tab.

For income taxes its only when youve made more than about 53000 as a single person or 106000 as a married couple that your income tax rate goes higher than the 153 self-employment tax. Check throughout the day that your store is signed in to Restaurant Manager. Go to the Tax Documents section and Download your Yearly Summary for 2021.

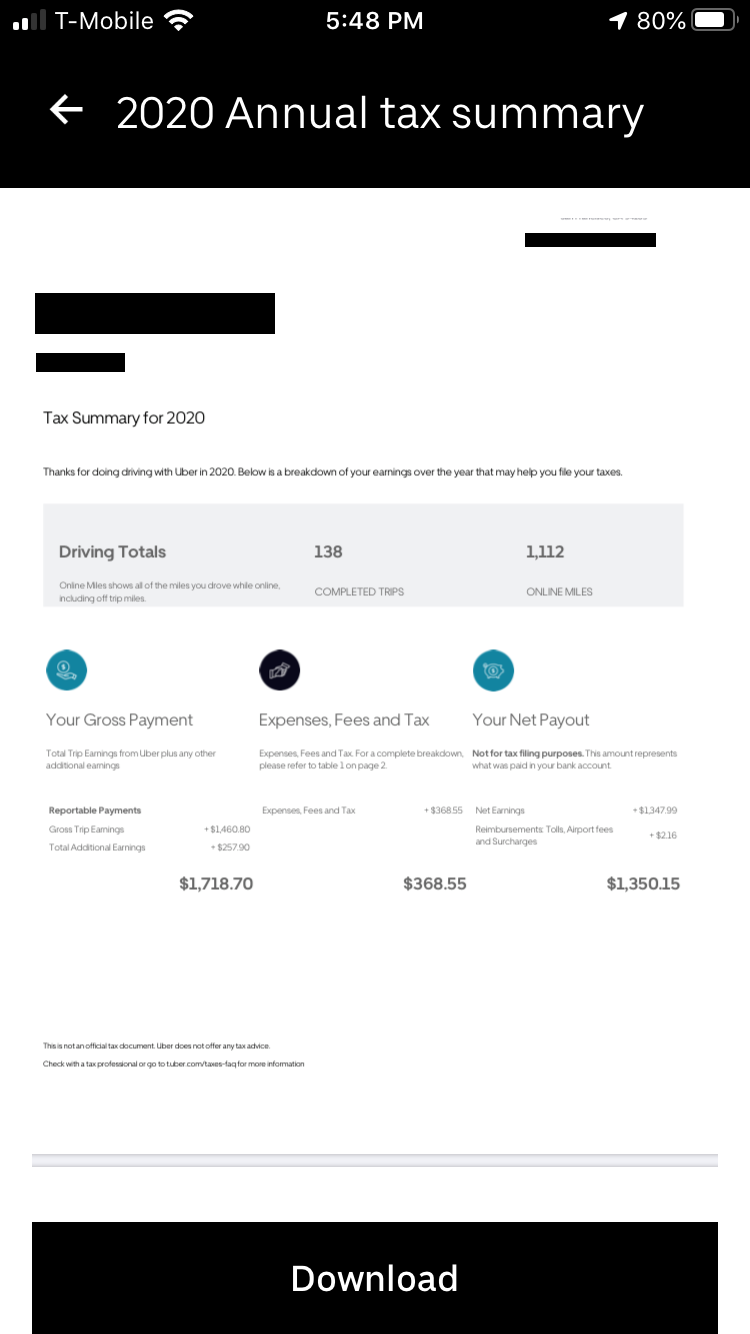

If you met the earnings thresholds to receive 1099s they should be available on the Tax Information tab by January 31st. Several spending categories will be included in your Yearly Summary like Tolls Black Car Fund Safe Rides Fee. Your Tax Summary document includes helpful information such as.

The uber service fee was 3830. Certain Uber expenses need to be combined and entered as a single amount in TurboTax. In Sept it says my gross was 5101.

Review the expenses in your Uber Tax Summary. Go to the Tax Documents section and Download your Yearly Summary for 2020. How Do I Get My Monthly Tax Summary On Uber.

It includes your earnings gross fares and some business related expenses. Scroll down to See all incomeIn the Self-employment section click Start next to Income. Fill out the Form 1040.

It also shows selected expenses you can likely deduct on your Schedule C. Your Tax Summary document includes. To enter your Uber tax summary.

Click on Tax Summary Select the relevant statement. The good news here is that Uber Eats provides an annual summary as part of their Tax Information. Accepting Orders should be visible in the bottom left corner of the dashboard.

One activity with Uber Eats and. If you met the earnings thresholds to receive 1099s and opted to receive a physical copy of your tax. If you log into your Uber driver account you can go to Tax Documents and then find your tax summary.

You will need to sign in. You will receive two tax summaries. Go to the tab Invoice Settings.

Its simply a form that shows your 1099-K and 1099-MISC incomes on one page. Except I shouldnt call it a tax summary because its not an official tax document. The uber service fee was 1531.

With the 1099 completed the last two steps are filling out the regular Form 1040 and paying your applicable taxes online or via mail. They report different income than what was deposited in your bank account and the uber tax summary can be confusing. There are two places you can find your Uber 1099 forms.

Consult with your tax professional regarding potential deductions. Look for the Tax Information tab. Select the Tax Information tab from the drop-down menu at the top of the page.

Your total earnings gross fares Potential business expenses service fee booking fee mileage etc Remember that the information provided is designed to assist with your tax management and is specific only to. It doesnt matter that you didnt get a 1099-K form. You can find your tax summary by clicking on Account in your app then clicking Tax Information.

Use the Uber Tax Summary to enter your income. The annual Tax Summary is a document provided to you by Uber that will help you complete your taxes. Maybe the most important document from Uber is your Annual Summary.

If your accounts for Uber Eats and Uber use a different email address your earnings from deliveries and rides will separately determine if you meet the earnings and trip criteria to receive a 1099-K 1099-NEC andor a 1099-MISC. Im having a bit of a problem determining how to read the monthly tax summaries properly. In the Statements section pick the month which corresponds to your desired outcome.

So my net total was 3570. Click on Tax Summary Select the relevant statement. The important thing on the annual summary is the part they call Expenses Fees and Tax.

Taking advantage of Billing on the left is a good idea. Every driver and delivery person on the Uber app will receive a tax summary. In addition you should be able to download them in your Driver App under Account Tax Info Tax Forms.

Consider hardwiring your tablet if you believe negative report numbers are due to your wifi connection. One thing to understand is that Uber Eats does their tax documents like 1099 forms kind of funny. Your annual tax summary will be available by January 31 2022 on the Tax Information Tab of the Driver Dashboard.

But its very valuable for your tax purposes because theres one important number you wont likely find anywhere else. If you select this option youll be able to view that months payments overview PDF. Your 1099 should be there by January 31st.

As a gig economy contractor your self-employment taxes are almost always higher than income taxes. Visit the Tax Documents area and download your Yearly Summary for 2020 from the websites server. Heres the thing.

The Uber tax summary isnt an official tax document. Continue through the interview to enter your business information. For purposes of this tax calculator just use the total money you actually received from Uber for the year.

Uber provides an annual tax summary of all of your earnings. Your total earnings gross fares Potential business expenses service fee booking fee mileage etc Remember that the information provided is designed to assist with your tax management and is specific only to your activities as an Uber partner. In Oct it says my gross was 12765.

To review your Uber expenses. Uber Eats Income. You will receive one tax summary for all activity with Uber Eats and Uber.

Dedicate a front counter register to processing Uber Eats orders. From here Uber driver taxes are a bit easier to handle. When is it available.

Go to Federal Income. To review your Uber expenses. Uber Eats and the Annual Tax Summary In my opinion the annual summary is the most important of the three documents you can download from the Tax Information tab in your Uber account dashboard.

When you get to the Lets Review Your Work Info screen make.

Uber Taxes Explained How To File Taxes For Uber Lyft Drivers Youtube

Uber Eats And Other Delivery Drivers Here Are The Tax Deductions To Maximize Refund In 2021 Accurate Business Accounting Services Campsie Tax Returns 49

Pin By Rain City Dreamer On Food Delivery Driver Tips In 2022 Food Delivery Grubhub Driver App

Most Loved Brands In The Us Gen Z Millennials Baby Boomers

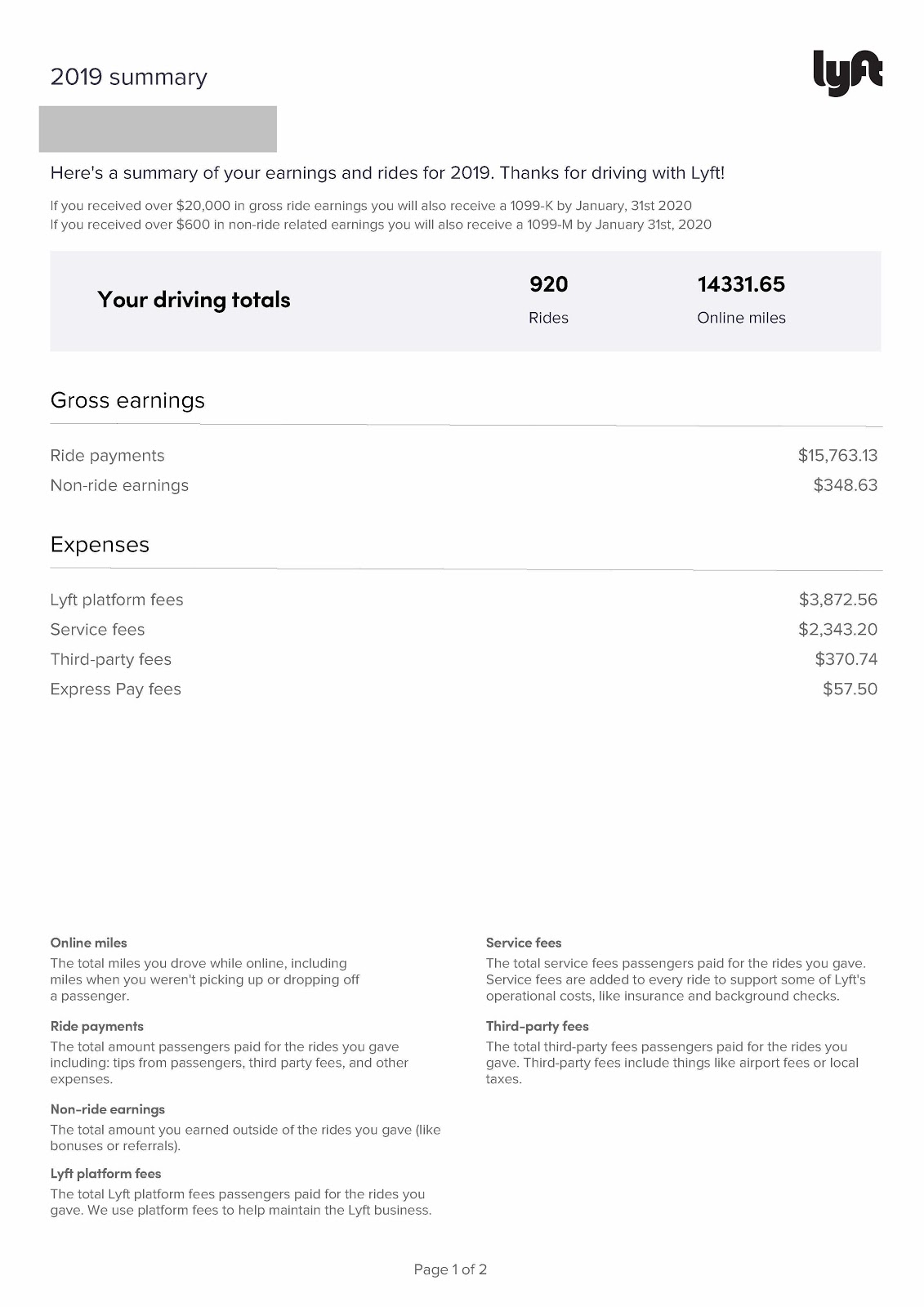

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

Uber Eats Does More Payment Volume Than Lyft S Entire Business Business Rules Lyft Uber

See This Post By Startup Ca On Google Https Posts Gle Ddif2 Www Startupca Org Decisions Announced Today At Fm Press Start Up Income Tax Return Income Tax

Uber Vat Compliance For French Partner Drivers

Documentos Fiscales Para Socios De La App

Why Does My Uber Eats 1099 Or Annual Tax Summary Say I Made More Than I Did Entrecourier

Become A Driver In Your City Using Uber Uber

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

How Do Food Delivery Couriers Pay Taxes Get It Back

How To Understand Uber Eats 1099s When They Lie About Your Pay

Why Does My Uber Eats 1099 Or Annual Tax Summary Say I Made More Than I Did Entrecourier